extended child tax credit calculator

It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. File a federal return to claim your child tax credit.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

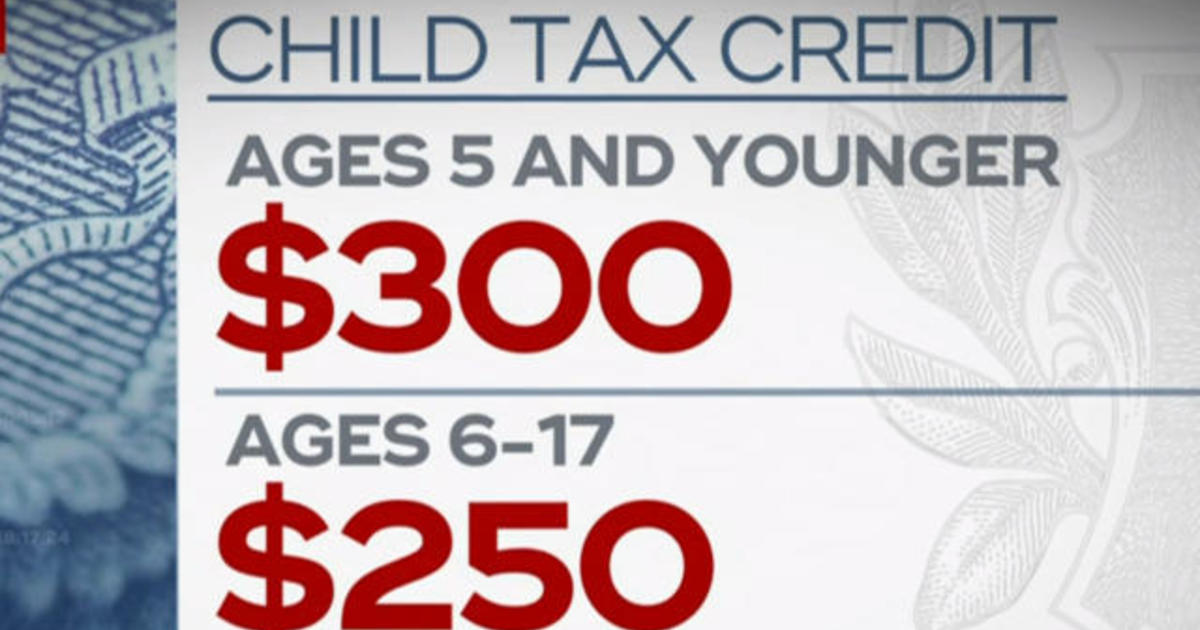

Since July millions of families have received monthly child tax credit payments of up to 300 per child.

. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Simple or complex always free. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6.

Use our monthly child tax credit calculator to estimate how much you might receive. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. The first one applies to the extra credit amount added to.

According to the IRS. If you already get tax credits You can still make a. For married couples and joint filers the credit will dip below 2000 if their.

The payments which could total as much as 300 for each child under age 6 and 250 for each one ages 6 to 17 will continue each month through December. The credit will be fully refundable. The American Rescue Plan Act of 2021 has upped the child tax credit substantially as high as 3600 per child ages 5 and under for qualifying people.

Get your advance payments total and number of qualifying children in your online account. To reconcile advance payments on your 2021 return. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

The other half of the credit can be claimed. Stock photo of calculator. You may be able to claim Universal Credit instead.

Tax credits calculator You can no longer make a new claim for tax credits. Enter your information on Schedule 8812 Form 1040. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

The Child Tax Credit will begin to be reduced below 2000 per child if an individual reports an income of 200000. Parents with higher incomes also have two phase-out schemes to worry about for 2021. Tax Changes and Key Amounts for the 2022 Tax Year.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

September Child Tax Credit Payment How Much Should Your Family Get Cnet

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

Try The Child Tax Credit Calculator For 2021 2022

Child Tax Credit Do You Have To Pay It Back In 2022 Not If You Re In These Cases Marca

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Schedule 8812 H R Block

5 Income Tax Tips For Notaries And Signing Agents Tax Deductions Irs Taxes Tax Questions

Explore Our Image Of Monthly Spending Budget Template For Free Budgeting Worksheets Budget Template Worksheet Template

Income Tax Calculator Estimate Your Refund In Seconds For Free

The Big Increase And More Changes To The Child Tax Credit In 2021

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis